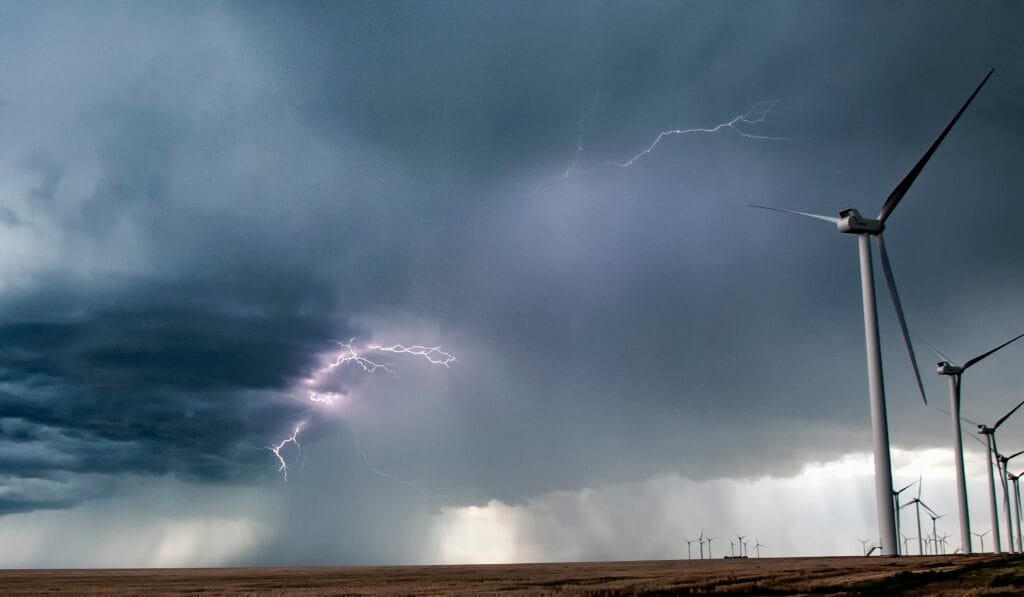

Spring brings warmer temperatures, blooming flowers, and longer days. However, it also brings severe storms, including heavy rains, hail, tornadoes, and strong winds. These weather events can cause significant damage to homes, vehicles, and personal property. Before storm season is in full swing, take the time to ensure that your insurance policies provide the coverage you need.

1. Review Your Homeowners Insurance Policy

Your home is one of your most valuable assets, and protecting it from spring storm damage is crucial. Here are a few key things to check in your homeowners insurance policy:

- Dwelling Coverage: Ensure your policy covers the full cost of rebuilding your home if it suffers storm damage.

- Personal Property Coverage: Verify that your belongings—furniture, electronics, and clothing—are adequately covered in case of storm-related loss.

- Wind and Hail Damage: Some policies have separate deductibles for wind or hail damage. Know your deductible amount so you’re not caught off guard.

- Flood Insurance: Standard homeowners insurance does not cover flood damage. If you live in a flood-prone area, consider purchasing a separate flood insurance policy.

2. Check Your Auto Insurance Coverage

Spring storms can bring hail and flash floods that may severely damage vehicles. Here’s how to make sure your car is protected:

- Comprehensive Coverage: This covers damages from non-collision incidents such as hail, falling trees, or flooding.

- Rental Car Reimbursement: If your car is in the shop due to storm damage, having rental reimbursement coverage can help cover the cost of a temporary vehicle.

3. Inspect Your Umbrella Policy

If a severe storm leads to property damage or injuries on your property, you could face lawsuits or liability claims. An umbrella insurance policy provides extra liability coverage beyond your standard home and auto policies, offering financial protection in worst-case scenarios.

4. Take Preventative Measures

In addition to insurance, taking proactive steps can help minimize storm damage:

- Trim Trees and Secure Loose Items: Prevent branches and outdoor furniture from becoming dangerous projectiles in high winds.

- Inspect Your Roof and Gutters: Ensure your roof is in good condition and gutters are clear to prevent water damage.

- Create a Home Inventory: Document your personal belongings with photos or videos in case you need to file a claim.

5. Know the Claims Process

If your property sustains damage, knowing how to file a claim can save time and frustration. Keep your insurance provider’s contact information handy, document all damage, and take photos before making temporary repairs.

Protect Your Assets Before the Storm Hits

Spring storms are unpredictable, but your insurance coverage doesn’t have to be. At Greg Wilson Agency, we help homeowners and drivers ensure they have the right protection in place. Contact us today for a policy review and make sure you’re prepared for whatever spring weather brings your way.

☎️ Call us today or 📅 schedule a free consultation to review your insurance coverage!